That's why I'm turning Japanese

I think I'm turning Japanese

I really think so

I know I cannot be the first to use this analogy, but god bless new wave music & the 80's, for this apropos song.

With so much attention being paid to the Eurozone, specifically Greece’s departure from it and 165%

debt to GDP ratio in tote, its surprising to me that

nobody in the MSM mentions the king of

living beyond its means. This is none other than the spawn of

American ingenuity and the benchmark that all post-war reconstructions whom are

modeled after… Japan.

Japan’s

ascension from rubble after WW2 to the world's third-largest economy has been

staggering, especially for a country that’s about the size of the state of Montana.

With a population that values education as much as anyone in the world, Japan

has become a standard to many and no more than those in the corporate world,

noted for their dedication to innovation and organization. But if you dig a

little deeper, Japan and with all its glitz, glam & refined style; it isn’t

all what it seems.

Because, like all fiat facilitated economies, the debt

monster is alive and well and the only way to keep from getting swallowed up is

to keep pushing, keep innovating and never, ever under any circumstance become

stagnant. Well, at least over the last 20 years or so that’s been the case.

This is precisely what happened to Japan in the 1990’s known

in Japan and

around the world as Japan’s

“lost decade”. When the NIKKEI started to free fall and real estate prices

started to fall with it, those asset bubbles burst. This left the government in

panic mode, so like all bureaucracies do in a panic, they did the opposite of

what was right and did what was easy - threw money at it, instead of letting the natural correction run its course.

They began to doll out stimulus after stimulus (sound familiar?),

bailed out banks and insurance companies (getting warmer?) with the economy

still limping along they said the hell with it and raised its consumption tax 2

percent (doesn’t this sound familiar too?) which subsequently brought on another

recession.

After about two decades, and even with stimulus’s keep

piling on, Japan’s

economy finds itself in a ditch. Since 2011, the Bank of Japan has issued quantitative

easing programs in excess of 900 billion alone. With very little to no growth

potential, an aging population and an exponentially escalating debt tab; Japan

is running on borrowed time.

In a

recent interview with Spiegel Online's Anne Seith, The Bank of Japan's governor, Masaaki Shirakawa said:

"At the

moment, the effect of our monetary policy in

stimulating economic growth is very limited. The money is

there, liquidity is abundant, interest rates are very low -- and, still,

firms do not make use of accommodative financial conditions, the return on investment is too low."

Doesn't this sound eerily similar as well?

Japan is currently using 25% of its outlays just to service their debt. If they raise interest rates, the number will climb dramatically. This is why the US is

so fearful of raising its interests rates well. The FED wont entertain

raising interest rates until 2014, so imagine all the cheap money printed off until then? If we are to raise interest rates where we already pay 220 billion on basically 0% what will it look like if those rates go up?

As I pointed out back in March, via Kyle Bass, for every additional percentage point it will also bring about $140 Billion dollars on top of the existing 220 Billion.

President's FY 2013 budget, Congressional Budget Office

Japan’s

current debt to GDP ratio is currently 220%

according to IMF reports for comparison’s sake the US

debt to GDP ratio is about 102% (but that

number has doubled in just four years). Japan

however, unlike the US,

has a few unique circumstances that will either prolong a slow death or escalate

to their death at the speed of sound.

Graph: zerohedge.com

Japan

is one of the few countries that its public finances most of its debt (an astounding

95%). Thus, if they are comfortable with virtually no return on their investing

(0.75% average return) into the debt and increasing inflation, they can

literally keep financing their own debt as long as they don’t mind saving up to

go to the grocery store as if it were a vacation.

The other option(s) is eye popping and

absolutely lunacy to say the least. Newly elected Prime Minister Shinzo Abe wants the Bank of Japan

to start issuing “unlimited easing” starting with a 120 billion dollar bullet

into infrastructure. If that doesn’t get inflation where he sees fit and

despite a declining Yen the threats coming out of Shinzo Abe’s mouth, will

bring the death of Japan sooner rather than later.

In true, ancient Japanese kamikaze

fashion, the Liberal Democrat Shinzo Abe with all his love for easing (hello

Bernanke) is threatening to change the country’s laws and actually take the

Bank of Japan over: read quite literally, socialization.

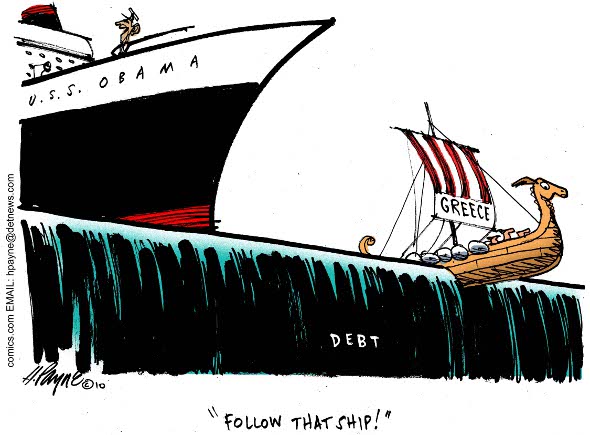

So, as you can see, here in the US

by all accounts, we are not Japanese yet. Although if we keep up this pace, follow

the Japanese playbook and we look at the last four years as any indication; it

should tell you it’s only a matter of time before we do.