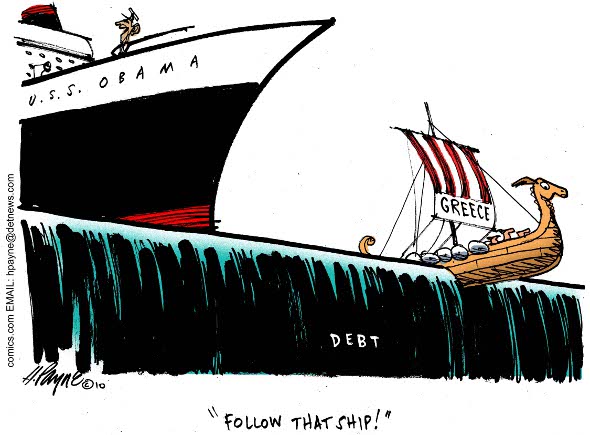

With Greece out on the corner whoring for another bailout and Standard and Poor yesterday lowering Greece’s credit rating to CCC (the lowest in the world) joining Moodys, who dropped Greece two weeks ago… it’s a great time to reflect. Or fittingly enough hold up a mirror to ourselves. Could the mighty US ever be in the same mess the Greeks find themselves in now? They are socialists you say and we’re capitalists, surly that couldn’t happen. Or Could it?

The Greek GDP is 329 Billion (2009). Obviously its not Rwanda. But let’s put that into perspective. The 2009 revenue of Wal-Mart was over 400 Billion. Wal-Marts annual revenue surpassed 174 nations that year. And being Wal Mart is just one company in the US, it gives you a feel for how truly large and powerful we are. So much so, that the US GDP is nearly three times its nearest competitor standing at 14.2 Trillion.

What separates the US from Greece? Sure we collectively output 45X in a year then they do collectively, but our external debt to GDP ratio is 100% on the nose as of tonight’s check. What we have that Greece don’t have is simple. We have a printing press. Our currency is traded throughout the world as the default currency. All we have to do is print our recovery (at the expense of massive inflation of course amongst other undesirables). The Greeks have to rely on a bailout from the European Union or default and declare bankruptcy. In many ways bankruptcy isn’t a bad thing for Greece. Because the sooner they can weed out mal-investment, waste and become more efficient the sooner they can get started in rebuilding. We on the other hand are so disillusioned our reckoning is going to be a lot slower and much much more painful.

So Greece having to default on its debt is one thing, for us to do it… that surly would send a ripple effect throughout the world. And that’s where the conversation truly ends. That’s where you get into raising the debt ceiling. Because after all, its not just the Chinese holding debt, its average Americans too. We can stick it to those red chinamen… but we refuse to and won’t default on Grandma Sherley. I mean, Standard & Poor's may be forced to take away our AAA credit rating, or what basically what amounts to as being a credit card with no limit!

At the current rate, in a few months we will start to default on our debt. The disease of debt and living beyond our means at a national level are over. The diagnosis isn’t going to change. The treatment is the only choice we have. Take the medicine now by choice, or be forced to do it later. And we have two responsible options to do this now and one irresponsible one that will only make things worse.

We can default on our debts and admit to the world and to ourselves that we are living well beyond our means or raise taxes and pay our way. If our 2011 budget deficit is 1.6 Trillion and we have roughly 160 million working Americans, all we will need is 10g per working American to cover this years shortcoming (hows that for stimulating the economy, suck 1.6 trillion out of citizens hands and into the coffers of out of control and out of touch government).

Or we can do what what politicians always are in favor of doing, and that is to let the next guy worry about it and continue to kick the can down the road, raise the debt ceiling, creating an oncoming tsunami at what point could be a country in total chaos. Lets see what kind of chutzpah these elected “leaders” have the rest of this summer. Based on past results, i dont think the shoe business should need a bailout.