The NCAA tournament isn’t over yet but we know its coming to

an end in exactly 16 days. If I was to tell you it’s not over yet, I would be

correct. But does change the fact that is will end? Of course it doesn’t. For

many people, because we haven’t seen bread lines or riots in the streets the “sky

isn’t falling” yet. Does that change the reality that our economy is on the

downside of the bell curve?

When the FED dropped interest rates back in ’07 the idea was

that it would incur borrowing from the public & private business; therefore

creating new/bigger business and in the process creating jobs or at least not hemorrhaging

more than the economy was already in the process of doing. Then the rates kept

dropping and dropping and wont go up until the very least 2014 and then what?

Go up? The debt will explode in a hyperbolic fashion.

This graph shows we paid MORE in interest on our debt in

2008 (10,024,724,896,912.49) then we did in 2012 (16,066,241,407,385.89). How

do you pay LESS interest on six trillion more in principal? There is only one

solution; you pay substantial less interest.

As we know, unemployment has dropped from its high of 10.0%

back in ’09 to 7.7% as of last month but at what cost?

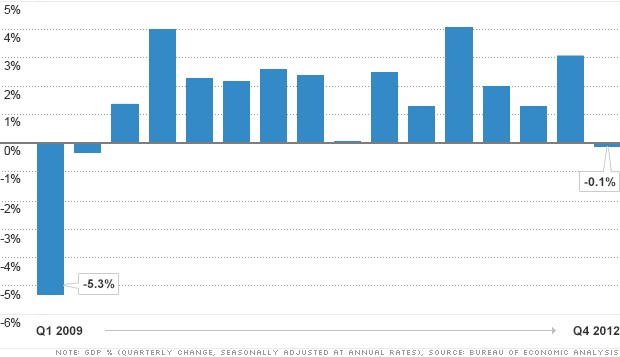

GDP has only seen moderate gains during the last five years

and in fact, as you can see below, the last quarter actually seen our GDP in

decline; despite the fact that private GDP rose in the same period.

Some people will point to the cuts in defense spending as

the main culprit and

they would be correct (as defense have seen a 22% drop in spending) but if

running nothing short of an empire and that is how we

are keeping afloat in the first place, well…

Mortgage rates are now at their lowest rate in recorded

history and this has been a yearly trend these last few years. Only now in

March of 2013, are we beginning to see signs of the real estate market coming

back to life; despite a plummet in interest rates the last six years that were

supposed to (as said in my opening) entice borrowers. Was it worth it?

Was it worth it and at what cost are the two questions I pose

to you today. At what cost and is it worth it to live for today at the expense

of tomorrow?

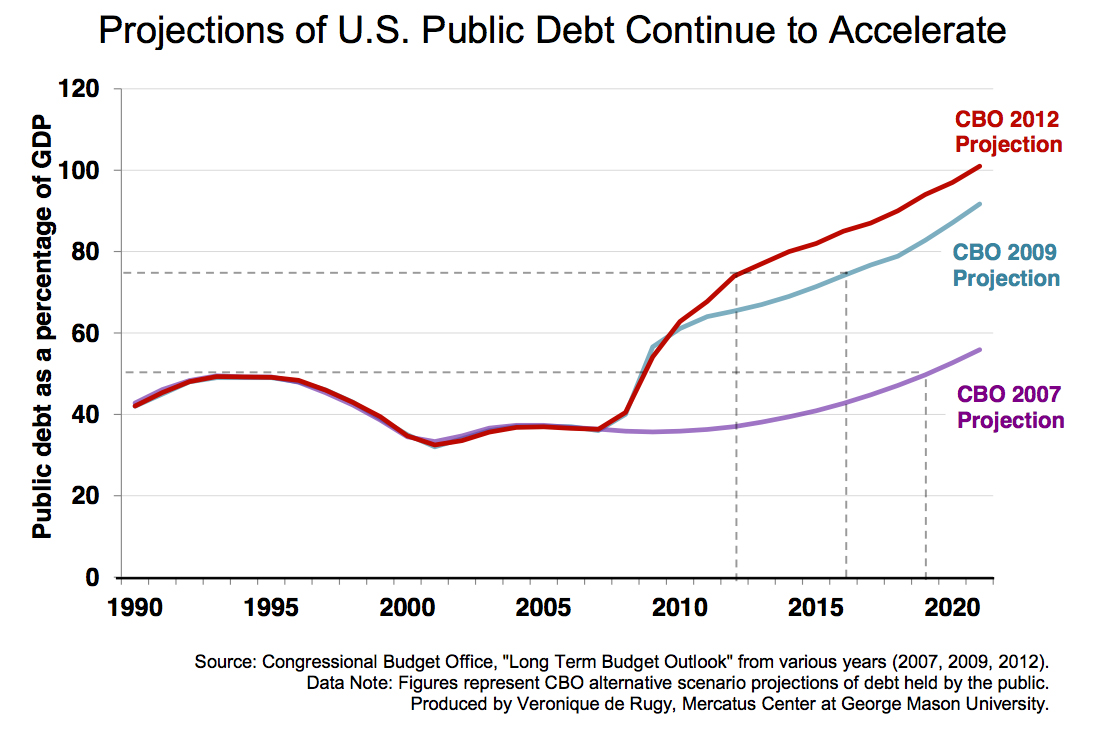

The CBO estimates of this nation’s debt keep getting worse,

study after study. This is a quite simple process: the interest rates remain

low, the debt piles up and the economy barley moves. These projections below

are based on current conditions. Remember,

zero is the end game; there isn’t much that can be done after that. We are basically

at zero interest rates now.

These examples I gave are just the tip of the iceberg and they are all interconnected. And that iceberg is the general public of this nation being so inundated in debt, so much so that we are getting to the point where offers of basically free money can’t move the needle any longer. These last four years of record low interest rates with barley a crawl until four, five sometimes six years later illustrates this quite luminously.

With wages not keeping up with real inflation (not the phony

government statistics) and the globalization of the market, incomes for the

average American (an overwhelming majority of) are stagnated; if not in

decline. Is there any way that changes? Of course not, this is the new reality.

So to keep up, for most Americans, debt is the only logical

solution. Afterall, we know saving via the conventional bank route is futile

with rates being under 1%. And as we know debt = money, so when the economy can’t

jump start and the FED’s QE programs don’t jump start growth; what else can the

FED do? It’s been said by Bernanke that the quick death of deflation will not

occur, so that only leaves one alternative; go to zero and close its eyes. Then

hold on for limb and life as the decent to a slow death via hyperinflation

begins.

The political process here has become a joke. A crooked game

ran by self-serving lawyers and career politicians hell bent on seeing who can kick

the can down the road the furthest. What was once a calling of statesmen has been replace by a bloodthirsty pack of statists. Republicans blame Democrats for not cutting

spending despite having no solution themselves and god-damn you if you want to

cut a bloated defense budget! Democrats want to actually ADD to the problem

with a monstrosity addition to healthcare. While both “sides” will tell you it’s

the other guys fault. Then all the puppets and zombies watching/reading the

propaganda will parrot it. You think this is going to change?

At this moment, under these terms we are watching the beginning

of the end finally become visible before our very eyes. Americans and their

distractions have reached the crescendo. They can no longer afford them. The

sky isn’t falling, but our economy is. It’s circling the drain, not as fast as Greece

or Spain but

its circling nonetheless. So move over American Idol, the freak show isn’t just

in your living room its right outside your window. Get ya’ popcorn ready.