This

The second part of the blog entry entitled: How to fix the economy: throw your wife back in the kitchen, barefoot and pregnant is optional

This is the most complicated aspect of working mothers in the workforce and the part that would be considered third-rail politically; the economic impact. I feel to date, this might be the most important topic I have talked about on this blog because it affects all of us on so many levels. I would like to think after reading this you would agree.

The confusing aspect of this, as mentioned in Part 1, is not intertwined in the complexity of the argument. On the contrary, it lies in the simplicity of it; yet it’s not even in the discussion of what ails our economy?

When it comes to children being cared for outside of the home, its hard to find clear cut data that points out positively home is better, thus I’m sure someone could call it subjective. Now it's common sense having one parent home works better but I like to deal in absolutes rather than conjecture. What is totally objective is the impact of working parents (and to a degree women in general) on the economy. This all can be traced back to two words: supply and demand.

Obviously, with any prospering nation, the population has been on the incline since its inception. Thus, there have always been more than enough people looking to work. If we compare our population today (315 Million) to 1960 (180 Million) we can see a 75% increase in population in 53 years. In 1960, there were 69 Million Americans employed. Today, there are 155 million Americans employed. That’s a 125% increase in Americans working today from 1960. If we include real unemployment numbers in one of the worst economic recovery’s in history (said to be about 22 million more Americans) that 125% climbs over 150%.

Adjusted for population and time, we have seen the true workforce expand more than 25% in 53 years. Even with the staggering unemployment, we are seeing 49% of our population in the workforce compared to just 38% in 1960. As we know, women entering the workforce deserve the spotlight here, but with all these added workers, are we getting our money worth?

From almost every statistical standpoint the answer is simple. No. And it doesn’t end there. First, this is what the employment history looks like men versus women over the last 60 years.

As we can see, women have almost doubled their numbers, while men in the workforce have fallen about fifteen percent since 1960. With the influx of all these new workers over time, it’s only natural to expect that a “rising tide lifts all boats” scenario would exist but that just doesn’t seem to be the case. Despite the fact that the US has more billionaires than anywhere else on the globe, despite the fact that the average net worth of the newly elected 113th Congress is 966k; the average American family has been stuck in neutral for 40+ years.

Nothing paints this picture more vividly than what has happened and will continue to happen to the middle class. Like the time you left the bath running too long, low-interest rates/created new money has been filling up the economy. By the time you do notice and go to shut the faucet off, you find the handle is stripped (as there is no end in sight to new money with record low-interest rates). And no matter what you do, we cannot keep up with rising costs (inflation via new money).

You work and work and work some more. Your spouse goes to work; your youngest kids are off to daycare while your teenager competes with those without a high school diploma for jobs. Debt, credit, 2nd job... it doesn’t matter; whatever it takes, you will use any bucket you can find. You throw every bucket you can into that tub to keep it from spilling over, to keep from falling under that median. To keep that American dream still afloat. The fear of being poor is a great motivator. But to no avail.

As we can see below the median income has been relatively unchanged for Americans over the last 40+ years. In fact, today, real household income is LESS than it was in 2000, adjusted for that inflation. Meanwhile, the median income for males in this country is LESS today than it was in 1973. Does this sound like a 'dream' or progress? Women have gained roughly 80% in median income in this span but it's still substantially less than men (there goes that richer sex theory).

The destruction of the middle class is taking place before our very eyes. We have more people getting rich but substantially more getting poorer. I suppose this is “better for everyone” too? And this lunacy isn’t just limited to Time Magazine either. All media seems to be nothing but a mouthpiece for this propaganda. As I said yesterday, we know it’s not better for kids and more specifically the family and as we can clearly see here it’s been no blessing for the overwhelming majority of Americans economies either.

Let’s re-cap. We work long hours. We are flooding the job markets over the last 50 years with record number job seekers, turning upside down our outlook on work and family in our culture in the process. All of this just to keep a foot in the middle class or otherwise known as: ‘living the American dream’. But inflation (read theft) through loose (read suicidal) monetary policy and cost of living has not just made this 'dream' impossible but in turn nothing short of a nightmare.

If this sobering fact of our economy wasn’t enough, we also have the reality that nationally; this situation is even worse. In fact, this is how the banksters and those at the top of the pyramid power structure want it. After all, all this work and no gain by the masses have to go somewhere, right?

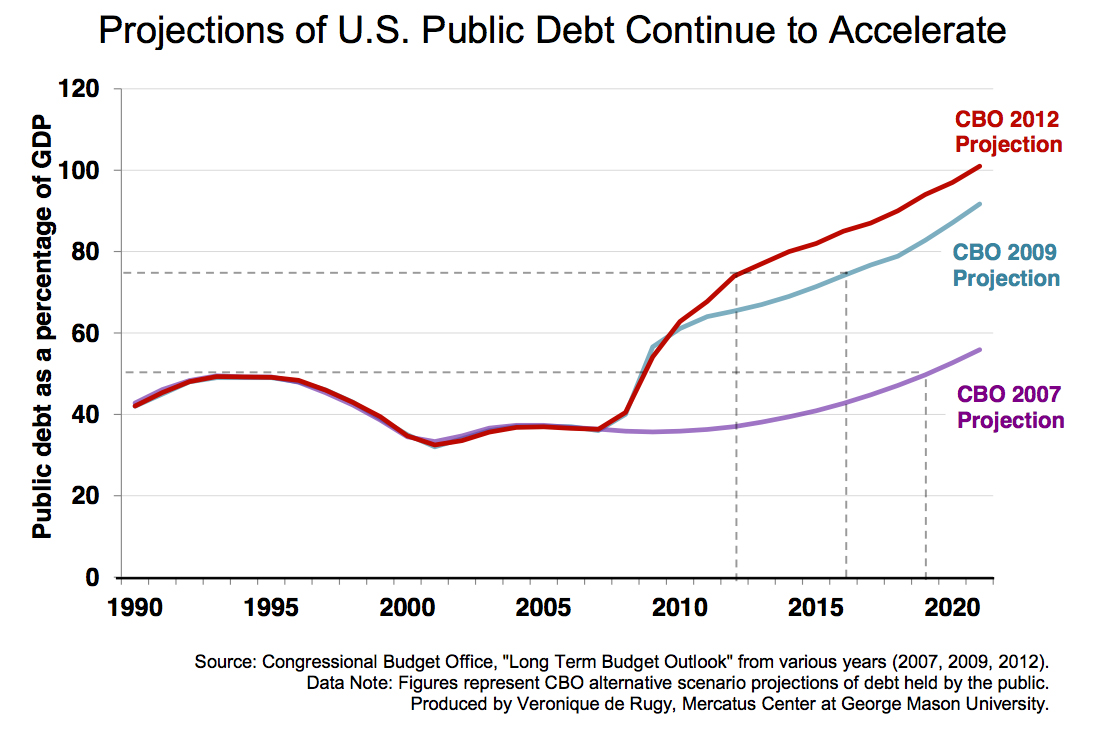

It wasn’t until 1982 that we as a nation reached a national debt over 1 Trillion (1,142,034,000,000.00). That took 191 years to reach that numerical milestone. Thirty years later, we have surpassed the 16 trillion dollar ceiling. As I have pointed out before, interest rates are at record lows to finance this gargantuan debt, thus we don’t necessarily have to feel the direct pain associated with such outlandish debt. But that doesn’t indicate there isn’t damage. The public debt side of the national debt has risen 140% since 2007, from 5.1 trillion to 11.9 trillion today. 140% in just six years.

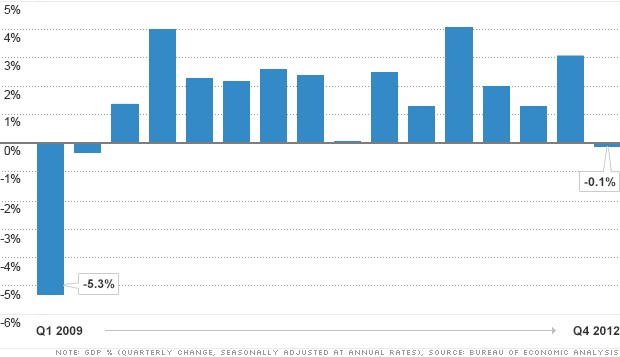

And for all this debt, we know GDP has grown, but really has it?

As we can see, our growth, like our economy, both micro and macro is nothing but an illusion. A dirty trick, made possible by the complacent yet complicit public. So eager, to be dictated by emotion, so much so that sound logic is actually discouraged and looked down upon. Have you seen the savings rates at your local bank? Check out a CD. You’d make a better investment buying scratch off lottery tickets than let your savings be ravaged by the fractional reserve banking system who rely on ‘kick the can down the road’ politicians who spend more time whoring for re-election than legislating. Or you know… what they were elected for in the first place.

You think it's bad, now? Wait until the FED start's raising rates again (if that's even possible).

This isn’t about women staying home and men working. The reality of men staying home while a woman works is not something that is concerning. What is concerning to me and should be to you is the reality of the American family. How one income is no longer able to support a family (regardless of the sex) and how we have been conditioned to accept this as the norm! As we can see, we are just barely staying afloat with two incomes, in the meantime causing major damage to the fabric of the family structure. What happens 30 years from now?

We are seeing our wealth being vaporized at the expense of our families and our way of life. This leads to only one thing. As “we” Americans continue to be duped, dumped-on and mislead, don’t expect things to change. We are paving our inevitable road that leads into a cul-de-sac of serfdom. I think George Carlin said it best in his last HBO stand-up before his death:

"The reason they call it the American Dream is because you have to be asleep to believe it."

So, wake up America, the wolves are already at the door.

The second part of the blog entry entitled: How to fix the economy: throw your wife back in the kitchen, barefoot and pregnant is optional

This is the most complicated aspect of working mothers in the workforce and the part that would be considered third-rail politically; the economic impact. I feel to date, this might be the most important topic I have talked about on this blog because it affects all of us on so many levels. I would like to think after reading this you would agree.

The confusing aspect of this, as mentioned in Part 1, is not intertwined in the complexity of the argument. On the contrary, it lies in the simplicity of it; yet it’s not even in the discussion of what ails our economy?

When it comes to children being cared for outside of the home, its hard to find clear cut data that points out positively home is better, thus I’m sure someone could call it subjective. Now it's common sense having one parent home works better but I like to deal in absolutes rather than conjecture. What is totally objective is the impact of working parents (and to a degree women in general) on the economy. This all can be traced back to two words: supply and demand.

Obviously, with any prospering nation, the population has been on the incline since its inception. Thus, there have always been more than enough people looking to work. If we compare our population today (315 Million) to 1960 (180 Million) we can see a 75% increase in population in 53 years. In 1960, there were 69 Million Americans employed. Today, there are 155 million Americans employed. That’s a 125% increase in Americans working today from 1960. If we include real unemployment numbers in one of the worst economic recovery’s in history (said to be about 22 million more Americans) that 125% climbs over 150%.

Adjusted for population and time, we have seen the true workforce expand more than 25% in 53 years. Even with the staggering unemployment, we are seeing 49% of our population in the workforce compared to just 38% in 1960. As we know, women entering the workforce deserve the spotlight here, but with all these added workers, are we getting our money worth?

From almost every statistical standpoint the answer is simple. No. And it doesn’t end there. First, this is what the employment history looks like men versus women over the last 60 years.

As we can see, women have almost doubled their numbers, while men in the workforce have fallen about fifteen percent since 1960. With the influx of all these new workers over time, it’s only natural to expect that a “rising tide lifts all boats” scenario would exist but that just doesn’t seem to be the case. Despite the fact that the US has more billionaires than anywhere else on the globe, despite the fact that the average net worth of the newly elected 113th Congress is 966k; the average American family has been stuck in neutral for 40+ years.

Nothing paints this picture more vividly than what has happened and will continue to happen to the middle class. Like the time you left the bath running too long, low-interest rates/created new money has been filling up the economy. By the time you do notice and go to shut the faucet off, you find the handle is stripped (as there is no end in sight to new money with record low-interest rates). And no matter what you do, we cannot keep up with rising costs (inflation via new money).

You work and work and work some more. Your spouse goes to work; your youngest kids are off to daycare while your teenager competes with those without a high school diploma for jobs. Debt, credit, 2nd job... it doesn’t matter; whatever it takes, you will use any bucket you can find. You throw every bucket you can into that tub to keep it from spilling over, to keep from falling under that median. To keep that American dream still afloat. The fear of being poor is a great motivator. But to no avail.

As we can see below the median income has been relatively unchanged for Americans over the last 40+ years. In fact, today, real household income is LESS than it was in 2000, adjusted for that inflation. Meanwhile, the median income for males in this country is LESS today than it was in 1973. Does this sound like a 'dream' or progress? Women have gained roughly 80% in median income in this span but it's still substantially less than men (there goes that richer sex theory).

The destruction of the middle class is taking place before our very eyes. We have more people getting rich but substantially more getting poorer. I suppose this is “better for everyone” too? And this lunacy isn’t just limited to Time Magazine either. All media seems to be nothing but a mouthpiece for this propaganda. As I said yesterday, we know it’s not better for kids and more specifically the family and as we can clearly see here it’s been no blessing for the overwhelming majority of Americans economies either.

Let’s re-cap. We work long hours. We are flooding the job markets over the last 50 years with record number job seekers, turning upside down our outlook on work and family in our culture in the process. All of this just to keep a foot in the middle class or otherwise known as: ‘living the American dream’. But inflation (read theft) through loose (read suicidal) monetary policy and cost of living has not just made this 'dream' impossible but in turn nothing short of a nightmare.

If this sobering fact of our economy wasn’t enough, we also have the reality that nationally; this situation is even worse. In fact, this is how the banksters and those at the top of the pyramid power structure want it. After all, all this work and no gain by the masses have to go somewhere, right?

It wasn’t until 1982 that we as a nation reached a national debt over 1 Trillion (1,142,034,000,000.00). That took 191 years to reach that numerical milestone. Thirty years later, we have surpassed the 16 trillion dollar ceiling. As I have pointed out before, interest rates are at record lows to finance this gargantuan debt, thus we don’t necessarily have to feel the direct pain associated with such outlandish debt. But that doesn’t indicate there isn’t damage. The public debt side of the national debt has risen 140% since 2007, from 5.1 trillion to 11.9 trillion today. 140% in just six years.

And for all this debt, we know GDP has grown, but really has it?

As we can see, our growth, like our economy, both micro and macro is nothing but an illusion. A dirty trick, made possible by the complacent yet complicit public. So eager, to be dictated by emotion, so much so that sound logic is actually discouraged and looked down upon. Have you seen the savings rates at your local bank? Check out a CD. You’d make a better investment buying scratch off lottery tickets than let your savings be ravaged by the fractional reserve banking system who rely on ‘kick the can down the road’ politicians who spend more time whoring for re-election than legislating. Or you know… what they were elected for in the first place.

You think it's bad, now? Wait until the FED start's raising rates again (if that's even possible).

This isn’t about women staying home and men working. The reality of men staying home while a woman works is not something that is concerning. What is concerning to me and should be to you is the reality of the American family. How one income is no longer able to support a family (regardless of the sex) and how we have been conditioned to accept this as the norm! As we can see, we are just barely staying afloat with two incomes, in the meantime causing major damage to the fabric of the family structure. What happens 30 years from now?

We are seeing our wealth being vaporized at the expense of our families and our way of life. This leads to only one thing. As “we” Americans continue to be duped, dumped-on and mislead, don’t expect things to change. We are paving our inevitable road that leads into a cul-de-sac of serfdom. I think George Carlin said it best in his last HBO stand-up before his death:

"The reason they call it the American Dream is because you have to be asleep to believe it."

So, wake up America, the wolves are already at the door.